Important Notices

NOTICE OF AVAILABILITY OF DOCUMENTS & COMPLAINT NOTICE

DOCUMENTS

Credit Union documents are available upon request. Members are entitled to review or receive a copy of our most recent statement of financial condition, annual audit summary, IRS Form 990 and credit union bylaws. Requests should be submitted to:

Highway District 9 Credit Union

2417 Columbus Avenue

Waco, Texas 76701

COMPLAINT NOTICE

If you have a problem with the services provided by this credit union, please contact us at:

Highway District 9 Credit Union

2417 Columbus Ave.

Waco, Texas 76701

Phone: 254-756-6331

Email: hwydist9cu@att.net

The credit union is incorporated under the laws of the State of Texas and

state law is subject to regulatory oversight by the Texas Credit Union

Department. If any dispute is not resolved to your satisfaction, you may also

file a complaint against the credit union by contacting the Texas Credit

Union Department through one of the means indicated below:

In-Person or U.S. Mail:

914 East Anderson Lane, Austin, Texas 78752-1699

Telephone Number (512) 837-9236

Facsimile Number (512) 832-0278

Email: complaints@cud.texas.gov

Website: www.cud.texas.gov

2024 Holiday Schedule - Office Closed

| New Year’s Day | Monday, January 1st |

| Martin Luther King, Jr. Day | Monday, January 15th |

| Presidents’ Day | Monday, February 19th |

| Good Friday | Friday, March 29th |

| Memorial Day | Monday, May 27th |

| Juneteenth | Wednesday, June 19th |

| Independence Day | Thursday, July 4th |

| Labor Day | Monday, September 2nd |

| Columbus Day | Monday, October 14th |

| Veteran’s Day | Monday, November 11th |

| Thanksgiving | Thursday & Friday, November 28th & 29th |

| Christmas | Tuesday, Wednesday, & Thursday, Dec. 24th, 25th. & 26th |

Board of Directors and Staff

| Name | Position | Term Expiration |

|---|---|---|

| Janis Guest | Chair | 2024 |

| David Swinson III | Vice-Chair | 2025 |

| Charlie Phillips | Director | 2025 |

| Peter Martelli | Director | 2024 |

| Kitty Powledge | Secretary/Treasurer | 2025 |

| Rachel Reavis | Manager | |

| Lorie Walts | Clerk |

A Message from our Chair

Welcome to the 70th Annual Meeting of the Highway District 9 Credit Union. Thank you for being here. Our success depends on the involvement of our member-owners, and we appreciate each of you for demonstrating your involvement here this evening.

As we continue to adjust to the post-pandemic world, Highway District 9 continues to perform well in adapting to this new economic landscape, as we will see in the Annual Report for the calendar year 2023. Let us consider the following highlights:

- Highway District 9 continues to be a well-capitalized financial institution with a strong net worth ratio of 22 percent. To put that in perspective, a net worth ratio above 7 percent is considered well-capitalized by our regulators.

- In total, our 734 members have added more than $3,494,995 to their savings accounts. This is less than we’d hoped for, but it is understandable in our uncertain economy, with rising food, energy, and gas costs, and climbing interest rates. At Highway District 9, we are constantly striving to improve our financial

services by welcoming and acting upon feedback from our members. Our goal is to assist members in making informed and beneficial financial decisions that align with their unique circumstances. - You, the member-owners of this institution, have borrowed more than $1,775,768, which added more than 115 new loans in 2023. Thank you for trusting Highway District 9 for your lending needs.

One of the benefits of credit union membership is the opportunity to share in the profits. Our members are always our top priority, and whenever we can, in keeping with our credit union mission, distribute profits back to you.

Last year, Highway District 9 performed so well that we generated $16,534 in net income in the 12 months ending December 31, 2023. As a result, we were able to pay out year-end dividends of $36,941. This is an average of $50 per member. Dividends were distributed to members’ share accounts and will be reflected on your semi-annual statements.

I would like to acknowledge my fellow board members for their dedication to this credit union. United in leadership, we are responsible for ensuring that your credit union has a capable, qualified, and transparent management team. I can say without hesitation that we do. The strength of the board’s commitment to the highest standards of governance and management is integral to Highway District 9’s well-being, sustainability, and prosperity.

Now, I would like to take a moment to express my deepest confidence in the leadership of Rachel, the commitment of our dedicated staff, and the support and loyalty of our member-owners. The last several years have presented changes and challenges, but they have also taught us that we are more than capable of facing an evolving economy and technological space in 2024. We certainly look forward to the opportunities to demonstrate our value proposition.

Thank you, ladies and gentlemen. I wish you and your families the very best this year.

Cordially,

Janis Guest

Chair of the Board

A Message from our Manager

Good evening and welcome to the 70th Annual Meeting of Highway District 9 Credit Union. My name is Rachel and I am the manager.

As we all know, credit unions are different from other financial institutions. That’s why we’re here today to remind you that as a member, you are an equal owner of the credit union, and we are accountable to you. Every member has an equal say in making decisions, and your vote counts. We appreciate you taking the time out of your busy schedule to be here and play an active role in your credit union.

Since the onset of the pandemic, credit union members have come to appreciate and value their trusted credit unions even more. In this post-COVID world, Highway District 9 is committed to providing the best value and experience to our members as the financial landscape continues to shift. While we have seen improvements in the economy, challenges still persist, leading to the financial industry developing more innovative and efficient processes. With the intention of providing a better banking experience, we’ve expanded our account options, simplified our processes, and eliminated or reduced fees for our customers.

There have been specific issues in Texas that have contributed to the financial landscape and economic trends at the local level. These include:

Manager

Treasurer's Report

I am delighted to inform you that the Highway District 9 Credit Union is secure and stable, exceeding the “well-capitalized” standards set by the National Credit Union Administration (NCUA). The credit union’s assets exceeded $4.5 million at the end of the year. By continuing to prioritize excellent member services and sound financial practices in 2023, Highway District 9 is dedicated to fulfilling its mission.

Highway District 9 is required by NCUA to submit a comprehensive financial report every quarter. This report helps credit unions compare their performance with industry standards and peers. I am pleased to inform you that our credit union ended 2023 with a net worth ratio higher than the regulatory requirement of 7 percent. At the end of the year, Highway District 9 was classified as a “well-capitalized” financial institution, with a 22 percent net worth of total assets.

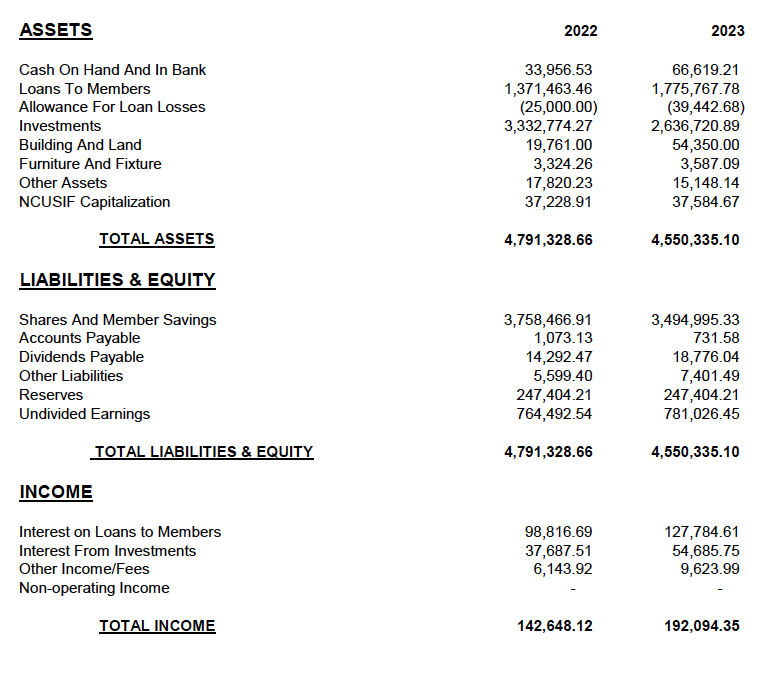

At the end of the year, the Credit Union had assets of $4,550,335. Out of this, $3,494,995 were shares, $1,775,768 were total loans (with an allowance for future loan losses of $39,443), and $2,636,721 were total investments. The net income for 2023 was $192,094, and our reserves and undivided earnings are a solid $1,028,431. Please refer to the enclosed financial statements for more details on the overall results of 2023.

Highway District 9 Credit Union empowers its members through consistent and positive financial assistance. This is achieved by improving the quality of its existing services and also by introducing new ones for the benefit of its members. The credit union is currently in good health and is committed to maintaining its safety and soundness while simultaneously enhancing the value for its members. It looks like a great year is ahead of us in 2024.

Respectfully submitted,

Katherine “Kitty” Powledge

Treasurer

Audit Report

My name is Jerry Brockington, Sr. and I am an independent representative who oversees the financial condition of Highway District 9 Credit Union. I work closely with the Board of Directors and am responsible for ensuring that the credit union’s financial reporting control process, a system of internal controls, audit process, compliance with laws and regulations, and operating policies and procedures are all in place and functioning as they should. Additionally, I am responsible for addressing any member concerns and verifying that the financial statements accurately reflect the credit union’s financial condition.

Throughout the year, we conduct internal audits and regulatory examinations to ensure that we are fulfilling our responsibilities effectively and responsibly. As part of this effort, I carried out an annual internal audit of the credit union’s books and performed a Bank Secrecy Act (BSA) examination. On November 16, 2022, the Texas Credit Union Department completed its most recent examination, which had an effective date of September 30, 2022. We reviewed the report with the Board of Directors.

After reviewing the written and oral reports submitted by myself and the examiners, I have concluded that the Highway District 9 Credit Union is in good standing. The credit union remains an invaluable financial partner for the members of Highway District 9 and is fully committed to providing critical services and financial solutions to the community. They strive to deliver quality services at competitive rates and constantly look for ways to improve their offerings. The team’s passion and mission to enhance member lives through quality financial services continue to drive the operations of the Highway District 9 Credit Union.

I am here to assist members of the credit union with any questions they may have or help them resolve any issues related to the credit union. As a representative of the credit union membership, I am always available. Members should verify all statements, report abnormalities, and update their address with the credit union. If you need any assistance, please feel free to contact the Supervisory Committee of Highway District 9 Credit Union at 2417 Columbus Avenue, Waco, Texas 76701.

Sincerely,

Jerry Brockington, Sr.

Internal Auditor

Where is your statement going to go?

UPDATING CONTACT INFORMATION

Your financial business is your business and does not need to fall into the wrong hands. So, if you have recently changed your location, or are planning to, please call us with your new contact information.

Keeping your address and phone numbers current serves three very important functions:

Important Changes to Your Account – Changes to your account must be communicated to you in writing. Without a current address, you could miss important details that affect your money.

Prevent Identity Theft – We mail your statements and disclosures to the address in your credit union records. If you no longer live there, this information can be intercepted by strangers and make you an easy target for identity theft.

Save Money – If the mail we send you keeps getting returned, we still have to pay postage. Incorrect addresses for just one percent of our membership ends up costing several thousand dollars a year. Since credit unions are not-for-profit, those extra expenses directly affect the products and services we can offer you.

UPDATE TO HIGHWAY DISTRICT 9’S FUNDS AVAILABILITY POLICY

In the past, if you’ve made a deposit that requires a hold, generally Highway District 9 makes the first $100.00 of that deposit available by the next business day – with the exception of a hold placed on a new account. As of July 21, 2011, when a hold is required on a check, Highway District 9 will make $200.00 of a deposit available on the next business day after the date of deposit.

MEMBERS’ ACCESS TO CREDIT UNION DOCUMENTS

Documents Available to Members. Upon request a member is entitled to review or receive a copy of the most recent version of the following credit union documents:

- Balance sheet and income statement (the non-confidential pages of the latest call report may be given to meet this requirement);

- A summary of the most recent annual audit completed in accordance with §91.516 of this chapter (relating to Audits and Verifications);

- Written board policy regarding access to the articles of incorporation, bylaws, rules, guidelines, board policies and copies thereof; and

- Internal Revenue Service Form 990

Questions?

Your statement should be carefully examined. If you need to update your account, the credit union can assist you. Alternatively, you can contact Jerry Brockington, Internal Auditor of Highway District 9 Credit Union, at 1117 Pawnee Drive, Waco, Texas 76705.

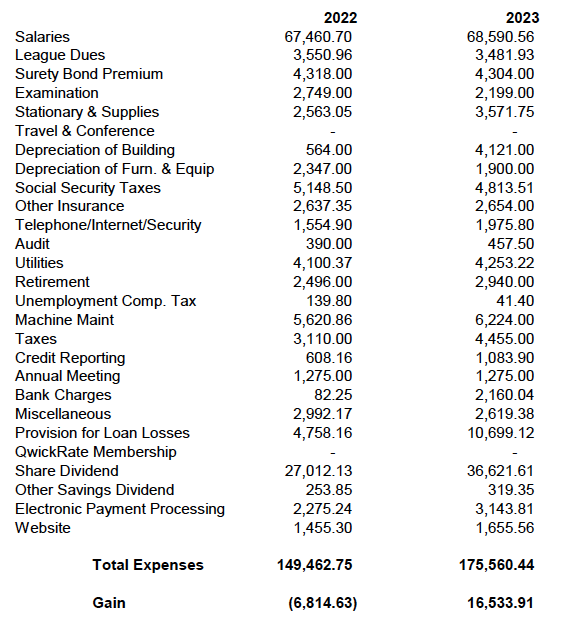

HIGHWAY DISTRICT 9 CREDIT UNION

EXPENSE STATEMENT AS OF DECEMBER 31, 2023

HIGHWAY DISTRICT 9 CREDIT UNION

STATEMENT OF FINANCIAL CONDITION AS OF DECEMBER 31, 2023

Valuable Information:

FAMILY MEMBERSHIP

Once you join Highway District 9 Credit Union, your immediate family members are also eligible to join. Credit union membership is truly a “family affair,” and many of our members take pride and satisfaction in bringing the many benefits of membership to those they love. Saving money, earning a better rate of return, and paying the lowest fees possible are just some of the benefits that you and all your family will enjoy!

| Eligible Family Members: | |||

|---|---|---|---|

| Mother | Father | Brother | Sister |

| Children | Grandchildren | Step Mother | Step Father |

| Step Children | Step Brother | Step Sister | Father in Law |

| Mother in Law | Brother in Law | Sister in Law | Grandmother |

| Grandfather | Spouse | ||

RATE MATCH PROGRAM

We know that you trust your credit union to provide you with excellent member service and products to help you meet your financial goals, but choosing a lender sometimes means taking the better rate, no matter who is doing the financing. But now, with rate match, you don’t have to go anywhere else! Even if you already have a loan through another lender, it’s not too late to save money and bring that loan home to Highway District 9. And if you’ve found a lower rate for a new loan with another lender, please give us the opportunity to offer you a rate match.

With our Rate Match Program, you can keep your business with your trusted, local credit union, and still great the best rate around. Eligible loans for the Rate Match Program Include:

- Auto loans (cars, trucks, vans)

- Recreational loans (motorcycles, boats, RVs, etc.)

- Other personal loans

We Accept Payroll Deposits, Debit Cards, and Bill Pay!

Highway District 9 offers a variety of electronic services. Our payment options make life easy for you. Visit our website to pay your installments and deposit your shares online. For more information about the programs and services offered at Highway District 9, please visit our website at https://www.hwydist9.com.