Important Notices

NOTICE OF AVAILABILITY OF DOCUMENTS & COMPLAINT NOTICE

DOCUMENTS

Credit Union documents are available upon request. Members are entitled to review or receive a copy of our most recent statement of financial condition, annual audit summary, IRS Form 990 and credit union bylaws. Requests should be submitted to:

Highway District 9 Credit Union

2417 Columbus Avenue

Waco, Texas 76701

COMPLAINT NOTICE

If you have a problem with the services provided by this credit union, please contact us at:

Highway District 9 Credit Union

2417 Columbus Ave.

Waco, Texas 76701

Phone: 254-756-6331

Email: info@hwydist9.com

The credit union is incorporated under the laws of the State of Texas and

state law is subject to regulatory oversight by the Texas Credit Union

Department. If any dispute is not resolved to your satisfaction, you may also

file a complaint against the credit union by contacting the Texas Credit

Union Department through one of the means indicated below:

In-Person or U.S. Mail:

914 East Anderson Lane, Austin, Texas 78752-1699

Telephone Number (512) 837-9236

Facsimile Number (512) 832-0278

Email: complaints@cud.texas.gov

Website: www.cud.texas.gov

2025 Holiday Schedule - Office Closed

| New Year’s Day | Wednesday, January 1st |

| Martin Luther King, Jr. Day | Monday, January 20th |

| Presidents’ Day | Monday, February 17th |

| Good Friday | Friday, April 18th |

| Memorial Day | Monday, May 26th |

| Juneteenth | Thursday, June 19th |

| Independence Day | Friday, July 4th |

| Labor Day | Monday, September 1st |

| Columbus Day | Monday, October 13th |

| Veteran’s Day | Tuesay, November 11th |

| Thanksgiving | Thursday & Friday, November 27th & 28th |

| Christmas | Wednesday, Thursday, & Friday Dec. 24th, 25th. & 26th |

Board of Directors and Staff

| Name | Position | Term Expiration |

|---|---|---|

| Janis Guest | Chair | 2027 |

| David Swinson III | Vice-Chair | 2025 |

| Charlie Phillips | Director | 2025 |

| Eric Olivas | Director | 2027 |

| Kitty Powledge | Secretary/Treasurer | 2025 |

| Rachel Reavis | Manager | |

| Lorie Walts | Clerk |

A Message from our Chair

Welcome to the 71st annual meeting of the Highway District 9 Credit Union. I commend all of you for taking an active

interest in our credit union’s one-member, one-vote structure and philosophy. I am Janis Guest, the chair of the Board of

Highway District 9.

As you will see in the Annual Report, Highway District 9 performed quite well in the calendar year 2024. Here are some

highlights from that report:

- Highway District 9 continues to be a well-capitalized financial institution, with a strong net worth ratio of 25.21

percent. To put this into perspective, a net worth position above 7 percent is considered well-capitalized by our

regulators. - In total, our 720 members have added more than $3,031,168 to their savings accounts. While this is less than we

initially anticipated, it is understandable since some of you faced challenges in saving due to inflation, changes in

the job market, or other financial demands. However, the good news is that we are seeing a positive turnaround

across the entire country. - You, the member-owners of this institution, have borrowed more than $1,726,753, resulting in the addition of

over 103 new loans in 2024. This reflects general optimism in our economy and trust in your credit union, for

which we thank you. - Auto buying slowed across the country due to inventory shortages that drove up vehicle prices. We are pleased

to note that despite rising prices and monthly payments, our members are generally keeping up with their

payments. - Higher prices motivated many of you to purchase previously owned vehicles. In 2024, Highway District 9 issued

35 auto loans for pre-owned vehicles totaling more than $324,426.

While the credit union needs to make a profit to continue operating, our primary interest is serving our members.

Whenever possible, in line with our credit union mission, we will distribute profits back to you.

Last year, Highway District 9 performed so well that we generated $4,285 in net income for the 12 months ending

December 31, 2024. As a result, we were able to pay out semi-annual dividends to our members totaling $43,305,

averaging $60 per member.

These dividends were deposited into member share accounts and reflected on their statements. This is just one way our

members can enjoy the benefits of belonging to a credit union.

I want to acknowledge my fellow board members for their dedication to our credit union. Together, we ensure that we

have a capable and transparent management team, which is vital for the well-being and prosperity of Highway District 9.

Our diverse board brings a wealth of financial and executive expertise, which has been invaluable to our credit union. I

have strong faith in our manager, Rachel, the guidance of our board, the commitment of our staff, and the support of

our member-owners. With our solid performance, I believe we are well-positioned to tackle challenges and seize

opportunities in 2025.

Thank you, ladies and gentlemen. I wish you and your families all the very best.

Cordially,

Janis Guest

Chair of the Board

A Message from our Manager

Good evening, everyone. I’m Rachel, the manager of Highway District 9 Credit Union. It’s truly a pleasure to welcome

you to our 71st annual meeting. I appreciate your commitment to being here today, and I’m looking forward to sharing

this important moment with all of you.

As you know, one key reason credit unions differ from other financial institutions is that you are at the heart of it all. Our

members are also our owners, and we are accountable to you. As a member-owner, your decisions matter, and your

participation through voting is vital. Staying informed about the current state of Highway District 9 enables you to make

well-informed choices that benefit us all. Thank you for taking the time out of your busy schedule to be here and play an

active role in your local credit union!

Though the pandemic is now in our rearview mirror, its impact continues to be felt—not only as a health concern but

also in how it forced us to develop new solutions for nearly every aspect of our operations. Because of these challenges,

our members have come to value how their credit union has supported them over the past several years with minimal

disruptions.

The outlook for credit unions in Texas is promising. According to the Credit Union National Association’s 2024 mid-year

report:

• Texas is home to 402 credit unions, with a total membership of 10,538,328, representing a 7.6% market share of

deposits in the state. This is a growing, though still relatively small, portion of Texas’s financial sector.

• Our average loan interest rates are significantly lower, providing substantial savings to our members—often by a

percentage point or more. For example, the average used auto loan rate is 6.33%, compared to a bank’s average

of 7.48%.

• Highway District 9 has $4,096,993 in assets serving 720 member-owners.

investments. This allows us to pass profits on to our members in the form of lower loan interest rates, higher yields on

savings, and fewer or lower fees.

participation and input of members like you!

environmental concerns. Addressing these requires our dedicated teamwork. Embracing the digital landscape will also

enhance our services for you and the community. At Highway District 9, your credit union, your input is vital to our

success.

Rachel Reavis

Manager

Treasurer's Report

I am pleased to announce that the Highway District 9 Credit Union is secure and stable,

exceeding the “well-capitalized” standards set by the National Credit Union Administration

(NCUA). At the end of the year, our credit union’s assets surpassed $4 million. By prioritizing

excellent member services and sound financial practices throughout 2024, Highway District 9

remains dedicated to fulfilling its mission.

The NCUA requires Highway District 9 to submit a comprehensive financial report every

quarter. This report allows credit unions to compare their performance against industry

standards and their peers. I am happy to report that our credit union concluded 2024 with a net

worth ratio exceeding the regulatory requirement of 7 percent. By the end of the year, Highway

District 9 was classified as a “well-capitalized” institution, boasting a net worth of 25 percent of

total assets.

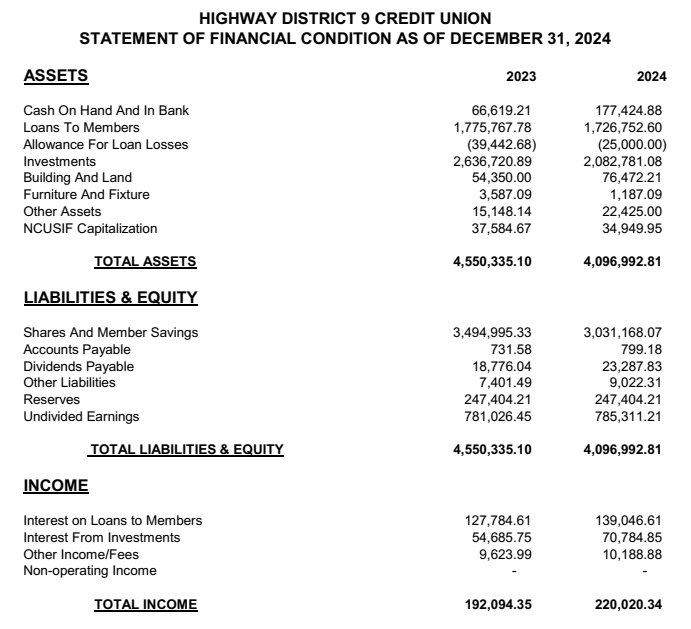

At the year’s close, the credit union’s total assets reached $4,096,993. Of this amount,

$3,031,168 was in shares, while total loans amounted to $1,726,753, which includes an

allowance for future loan losses of $25,000. Total investments were valued at $2,082,781.

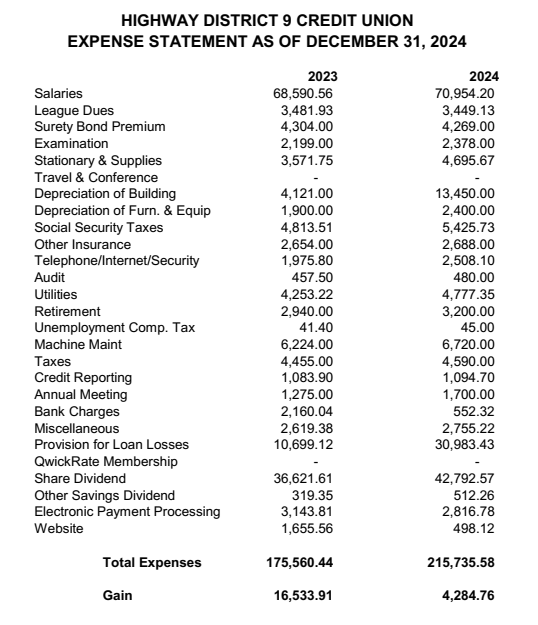

For the year 2024, the total income was $220,020, and the total expenses were $215,736,

resulting in a net gain of $4,285. Our reserves and undivided earnings stood at a solid

$1,032,715.

For more detailed information regarding our overall results for 2024, please refer to the

enclosed financial statements.

Highway District 9 Credit Union empowers its members through consistent and effective

financial assistance. This is achieved by enhancing the quality of existing services and

introducing new offerings for the benefit of our members. The credit union is currently in good

health and is committed to maintaining its safety and soundness while enhancing value for our

members. We anticipate a promising year ahead in 2025.

Respectfully submitted,

Katherine “Kitty” Powledge

Treasurer

Audit Report

My name is Jerry Brockington, Sr., and I am responsible for overseeing the financial health of

Highway District 9 Credit Union. I work closely with the Board of Directors to ensure our

financial reporting, internal controls, audit processes, and compliance with laws are strong and

effective. I also address member concerns and ensure our financial statements clearly show the

credit union’s financial position.

We conduct regular internal audits and regulatory examinations to maintain our high

standards. I have completed our annual internal audit and a Bank Secrecy Act (BSA)

examination. On April 4, 2024, the National Credit Union Administration (NCUA) and the Texas

Credit Union Department finished their latest examination, which was effective as of December

31, 2023. We reviewed the findings in detail with the Board of Directors.

After reviewing the examiners’ reports, I can confidently say that Highway District 9 Credit

Union is in excellent standing. We are a key financial partner for the members of Highway

District 9, dedicated to offering essential services and innovative financial solutions to our

membership. We aim to provide quality services at competitive rates and continually improve

our offerings. Our team is passionate about enhancing member lives through superior financial

services, which drives our work.

I am here to assist our credit union members with any questions or concerns they may have. I

encourage members to check their statements, report any irregularities, and keep their

addresses up-to-date with the credit union. For help, please contact the Supervisory Committee

of Highway District 9 Credit Union at 2417 Columbus Avenue, Waco, Texas 76701.

Sincerely,

Jerry Brockington, Sr.

Internal Auditor

Where is your statement going to go?

UPDATING CONTACT INFORMATION

Your financial business is important, and it should remain secure. If you have recently changed

your location or are planning to, please contact us with your updated information.

Keeping your address and phone numbers current serves three crucial purposes:

Notification of Important Changes – Any updates to your account will be communicated to you

in writing. Without a current address, you may miss vital information that could affect your

finances.

Preventing Identity Theft – We send your statements and disclosures to the address we have on

file. If you no longer reside at that address, sensitive information could be intercepted by

unauthorized individuals, increasing your risk of identity theft.

Cost Savings – If our mail continues to be returned due to an outdated address, we still incur

postage costs. Even incorrect addresses for just one percent of our members can result in

several thousand dollars in expenses each year. Since credit unions operate on a not-for-profit

basis, these additional costs directly impact the products and services we can provide to you.

Please keep your information up to date to ensure your financial safety and efficiency.

MEMBERS’ ACCESS TO CREDIT UNION DOCUMENTS

Documents Available to Members. Upon request a member is entitled to review or receive a copy of the most recent version of the following credit union documents:

- Balance sheet and income statement (the non-confidential pages of the latest call report may be given to meet this requirement);

- A summary of the most recent annual audit completed in accordance with §91.516 of this chapter (relating to Audits and Verifications);

- Written board policy regarding access to the articles of incorporation, bylaws, rules, guidelines, board policies and copies thereof; and

- Internal Revenue Service Form 990

Questions?

Your statement should be carefully examined. If you need to update your account, the credit union can assist you. Alternatively, you can contact Jerry Brockington, Internal Auditor of Highway District 9 Credit Union, at 1117 Pawnee Drive, Waco, Texas 76705.

HIGHWAY DISTRICT 9 CREDIT UNION

EXPENSE STATEMENT AS OF DECEMBER 31, 2023

HIGHWAY DISTRICT 9 CREDIT UNION

STATEMENT OF FINANCIAL CONDITION AS OF DECEMBER 31, 2023

Valuable Information:

FAMILY MEMBERSHIP

When you join Highway District 9 Credit Union, your immediate family members are also

eligible to become members. Credit union membership is a true “family affair,” and many of

our members take pride in sharing the benefits with their loved ones. You and your family will

enjoy a variety of advantages, such as saving money, earning higher interest rates, and paying

the lowest possible fees.

| Eligible Family Members: | |||

|---|---|---|---|

| Mother | Father | Brother | Sister |

| Children | Grandchildren | Step Mother | Step Father |

| Step Children | Step Brother | Step Sister | Father in Law |

| Mother in Law | Brother in Law | Sister in Law | Grandmother |

| Grandfather | Spouse | ||

RATE MATCH PROGRAM

We understand that you trust your credit union to provide you with excellent member service

and financial products to help you achieve your financial goals. However, when it comes to

selecting a lender, it may be necessary to consider the interest rate, regardless of who provides

the financing. But now, with our rate match program, you don’t have to look any further! Even

if you already have a loan from another lender, you can still save money by bringing that loan to

Highway District 9. Additionally, if you have found a lower interest rate for a new loan from

another lender, we would be happy to provide you with a rate match offer.

With our Rate Match Program, you can keep your business with your trusted, local credit union,

and still get the best rate around. Eligible loans for the Rate Match Program Include:

- Auto loans (cars, trucks, vans)

- Recreational loans (motorcycles, boats, RVs, etc.)

- Other personal loans

We Accept Payroll Deposits, Debit Cards, and Bill Pay!

Highway District 9 is proud to offer a range of innovative electronic services designed to make

your experience seamless and enjoyable. With just a few clicks, you can effortlessly make

payments for your installments and deposit your shares online through our user-friendly

website.

Discover the full spectrum of programs and services available at Highway District 9 by visiting

our website at https://www.hwydist9.com. We’re here to support you every step of the way!